Universal Credit: Uniting or Dividing?

- SupplyYourDemand

- Jun 14, 2020

- 5 min read

Updated: Jun 15, 2020

Brexit and COVID-19 have been at the forefront of our minds these past few months and years. However, one radical policy by the UK government that still needs to be talked about is Universal Credit. Universal Credit (UC) is part of the coalition government’s Welfare Reform Act of 2012 and was introduced in 2013. The initiative brings together six benefits into a single monthly payment in an attempt to simplify the welfare system. These 6 benefits are: Child Tax Benefit, Housing Benefit, Income Support, Income-based Job Seeker’s Allowance, Income-related Employment and Support Allowance and finally Working Tax Credit.

A transfer payment is a payment of money for which there are no goods or services exchanged. Generally, transfer payment is a term used to describe government payments to individuals through social programs such as benefits, student grants and social security (in the US). The main aim of welfare is to provide a basic floor of income or minimum standard of living for low income households; these are considered a means of redistribution of wealth to the poorly compensated.

To be eligible to receive UC, claimants must be unemployed, or on low income; aged 18 or over, or under pension age; a resident of the UK; and have less than £16,000 in savings together with their partner.

The principle difference between the old benefit system and this new Universal Credit scheme is the frequency of payments. Under the old system, benefits were paid fortnightly or less, while UC is distributed every 4-5 weeks.

A reason why the government reformed the benefit administration was to incentivise employment. This explains why under the adapted scheme, claimants are able to receive UC even if they are employed. In October 2019, there were 2.6 million UC claimants, which counts for just over a third of claimants in unemployment.

Finally, under the previous system, the specialised Housing Benefits would cover costs of rent. The revised payments integrate many types of benefit together, thus instead of specifically allocating housing costs, rent is directly paid as part of UC.

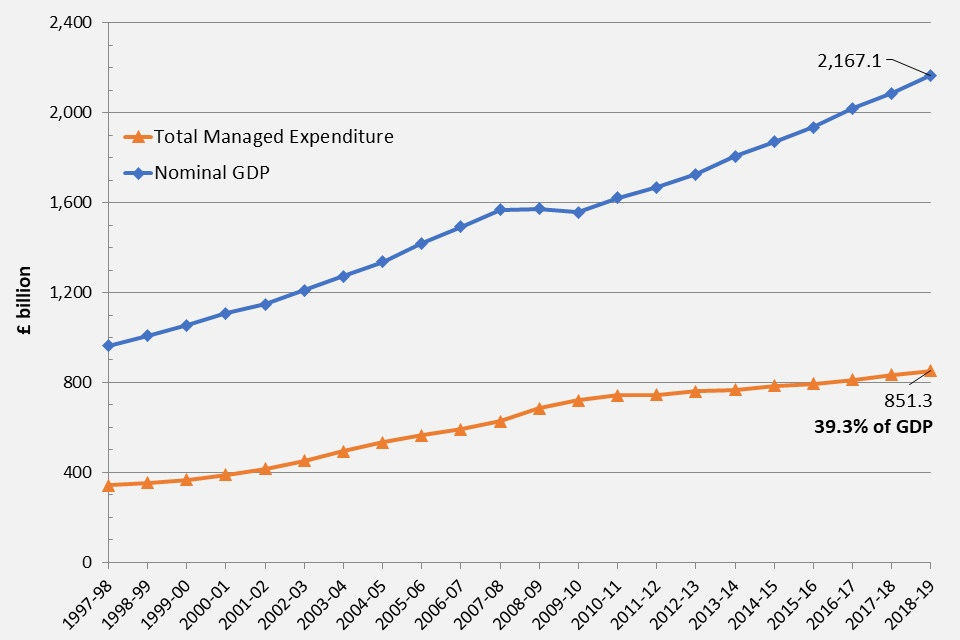

(1) The UK government spends a large proportion of it’s annual budget on social protection as shown here. As illustrated, this amount has been constantly rising. Later on, we will discuss the current impact of Covid-19 on this level of spending.

As mentioned above, one of the main differences is that UC is paid every 4-5 weeks. This is dangerous as it increases risk of debt, rent arrears and reduces financial security. The risk of debt rises because if a household is not financially smart and does not understand how to split their finances, the household may end up spending all their income at the beginning of the month; this results in not enough money being left over to get them through the last few weeks before their next payment. For example, households may not be left with enough money to pay for rent. This would not have been such an issue before Universal Credit, where households were paid Housing Benefits separately, thus allowing them to set aside the money and pay their landlord.

Also, those eligible for Universal Credit must claim it online. This is a particular problem for UC claimants, as many do not have access to the technology required to make the claim, or the skills needed to fill out the form. This means that many people are left disadvantaged and unable to successfully make the UC claim. However, from 29th November 2017, a free helpline was set up for Universal Credit claimants. Thus, claimants are now guided through the process, step-by-step. Figures suggest that this has been successful as 99% of applications are made online.

Some may say that the structure of Universal Credit is too strict and leaves many desperate by the end of the 5 weeks. On the other hand, some may argue that it is because of this strict structure that people are better off in the long-run. They argue that Universal Credit allows enough income for households to buy their necessities,, for example food, water, and rent, but not enough that it would be preferable to claim Universal Credit than work. Thus, households are incentivised to get a job that pays a higher income, leading to lower unemployment levels in the UK economy. Unlike the Job Seeker’s Allowance, UC payments won't just stop because earnings have changed. Rather, they will remain the same until you pass the Work Allowance. This means that your total income will be your wage, plus the UC income households receive. Once a household earns more than the Work Allowance, their UC payments will gradually be reduced at the Universal Credit taper rate of 63%; meaning that for every £1 earnt above the Work Allowance, the UC payments will fall by 63 pence.

The importance of UC has been highlighted by the current pandemic, as transfer payments are in place for both humanitarian reasons and, at times of economic distress, to help stimulate the economy by hopefully creating more disposable income and thus more demand. Transfer payments are often introduced or expanded during severe economic recessions. Social security, for example, was created by the Roosevelt administration during the Great Depression (look out for our blog on this coming soon!). Sure enough, in March 2020, we saw our current Chancellor Rishi Sunak announce the unprecedented Coronavirus Job Retention Scheme in which the government pledged to pay 80% of wages (up to £2,500 a month) for those not working in order to retain jobs. This furlough scheme has since been extended to October 2020, highlighting the urgency and necessity to which the UK requires fiscal stimulus in the form of direct transfer payments to individuals, much like UC.

Even in the US, Treasury Secretary Steven Mnuchin supports sending money directly to Americans as part of the $1trillion (as of 17 March 2020) stimulus aimed at averting the economic crisis caused by the Coronavirus.

Overall, we believe that although Universal Credit is theoretically a great idea to boost employment whilst maintaining a welfare state, it does not take into account the most basic of issues like who can access the form to claim UC, and the unsustainable choice to send UC payments every 5 weeks. With further reform to provide financial education to those receiving transfer payments, and possibly the introduction of training (for example T-Levels) and apprenticeship schemes, hopefully, low income earners and unemployed individuals in the UK will have the opportunity to benefit from this scheme while be encouraged to propel themselves into the labour force. Thus, the UK may experience economic growth and lower unemployment through the higher levels of disposable income and greater consumer confidence.

This is a link to a real life of a family who have been negatively impacted by UC.

Co-authored by Priscilla Chau and Sarita Kumari

All data has come from the Gov website, unless otherwise stated.

Comments